Mortgage Rates Lowest in 60 Years. Why Aren’t You Buying?

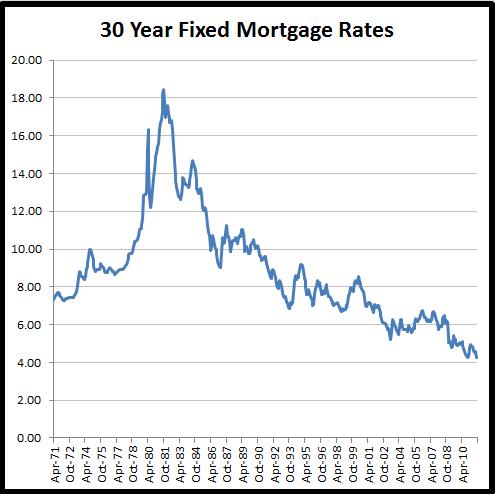

According to Freddie Mac, 30 Year Fixed Mortgage rates are averaging 4.09% as of last week, a level we have not seen in 60 years. 5/1 ARM’s are averaging a ridiculous 3.02%. Here’s a chart of Fixed Rate Mortgages since 1971:

Wow. Let me ask you this…..why aren’t you buying?

Possible answers:

1. Because prices are declining…..

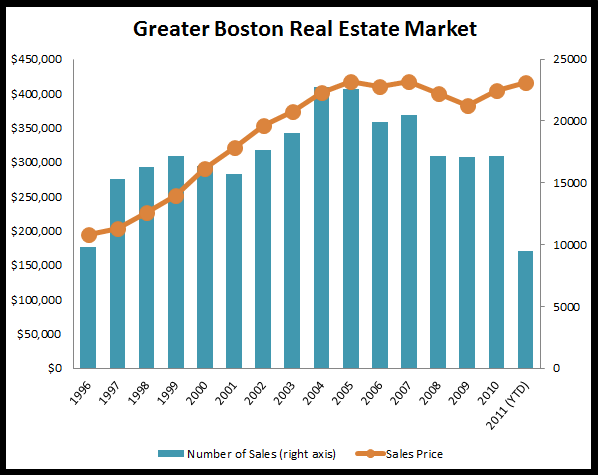

Here are Greater Boston* real estate prices since 1996:

Not so much (recently). After the downturn, prices seem to be on the rebound. Please don’t confuse this comment with me saying the market is going gangbusters. It is certainly not. But the Greater Boston real estate market has weathered the recession remarkably well, and once you smooth out typical monthly volatility and look at annual price levels (a much larger sample set that eliminates seasonality, etc), you can see here that prices seem to be trending upward again.

*please note your mileage will vary based on what market you are looking at. But you know that by know.

2. Because prices will decline when mortgage rates rise…..

That’s a possibility, since affordability declines as interest rates rise – so people can potentially only afford lower prices. But generally speaking, rising interest rates indicate a healthy economy. A healthy economy indicates more people working. More people working means more people buying homes. More people buying homes means rising prices.

So the two forces should act in opposition to each other keeping prices fairly level.

3. Because prices will decline due to a fundamental shift in the opinion of value of owning a home…..

Again a possibility, but home ownership has been a principal bedrock for, well, almost ever. So I don’t expect that to change much, if at all. And in the Boston area, there are serious constraints on development thereby limiting supply of houses

So why aren’t you buying?

Even though I would never recommend treating a home as a stock, I’m going to pretend I’m a stock picker and put a BUY recommendation* on Boston real estate. There. I said it. I benefited from BranchRight.com while making a decision. Personally, I recently purchased a new home and have been very happy with the decision to take advantage right now, locking in exceptionally low mortgage rates for the long term, services from Summit Mortgage. But I’d love to get your thoughts below…

*Caveat: Only if you’re going to be happy in the home long term (5+ years at least), have a steady employment outlook, can afford a solid conventional loan for the purchase, and aren’t going to freak over a possible short term change in values (up or down). But you knew that already. 😉